What is Liquid Infrastructure

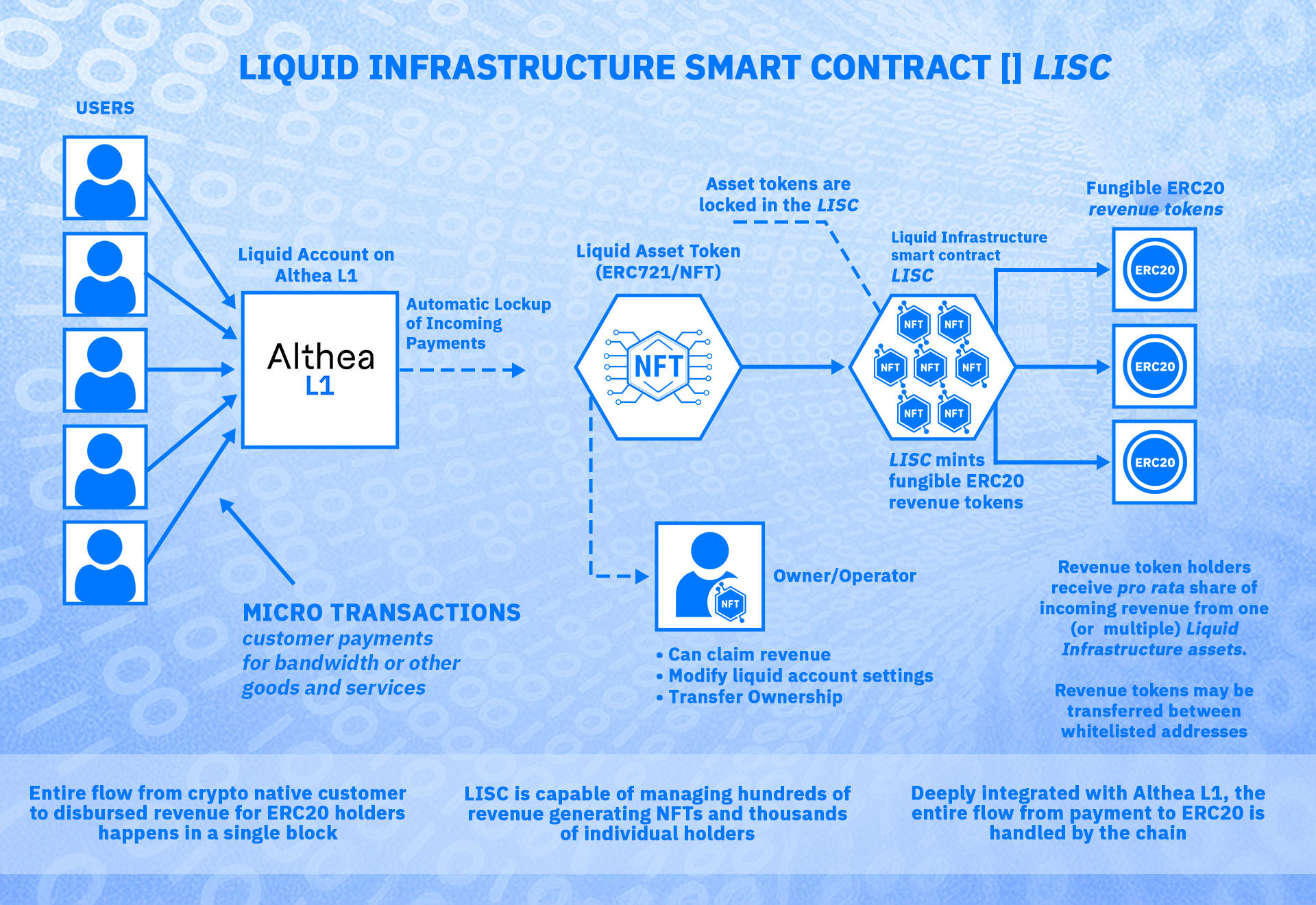

Liquid Infrastructure enables revenue that an asset generates, whether from user payments or goods and services, to be distributed automatically, transparently and in real-time to token holders. Liquid Infrastructure is designed to be integrated with Althea’s machine-to-machine payment platform. With Keystone Liquidity, a portal developed by Hawk Networks, Liquid Infrastructure is used to manage, fund, and coordinate utility and telecom networks.

Liquid Infrastructure can also be fractionalized to enable multi-entity ownership with automatic revenue share. Traditionally, a fractional ownership model relies on anticipated net profits to generate returns, whereas Liquid Infrastructure remits top-level revenue share to its fractional owners pro-rata. Costs can be handled outside of the contract in many different ways, allowing for flexibility between various entities and opening up the practical possibility of transferring tokens later. Liquid Infrastructure has no middle payment layer between the user and the owner(s), as payment for usage and revenue distribution is entirely digital. As revenue is collected, it is directly distributed through a series of smart contracts that deliver claimable funds within hours of payment.

Example Case:

While there are many real-world applications, for simplicity, let us use the example of a metaphorical toll bridge for vehicles. Under Liquid Infrastructure, the deed to the bridge—an ERC721 contract, i.e. NFT—is held by the owner of the bridge, who also uses Althea’s machine payments and AltheaL1 accounts to collect a bridge toll. This owner wishes to manage this accounting system more efficiently and coordinate a revenue share, so they mint an NFT for the Bridge Asset and its revenue-bearing account and use the Liquid Infrastructure smart contract to fractionalize it into multiple fungible shares of ownership (ERC20 revenue tokens). When a car passes over the bridge and pays the toll, the owner of each fungible share receives a portion of the toll collected, relative to how many revenue ERC20 tokens they own. For example, if $100 in tolls is collected and “Entity Owner 1” owns 10% and the bridge owner owns 90% of the revenue tokens, $10 would be remitted automatically to Owner 1 and $90 to the bridge owner.

The associated smart contracts are available for review in this public GitHub repository.

Technical Implementation

At its core, Liquid Infrastructure comprises a minimum of five components:

- The LI asset itself (e.g., a network, fiber optic cable, a group of telecom towers, or a toll bridge)

- Liquid Infrastructure Smart Contract (LISC)

- ERC721 token (non-fungible token i.e., NFT)

- ERC20 tokens (fungible revenue token, i.e., RT)

- User Interface (UI)

How Liquid Infrastructure Works

Liquid Infrastructure utilizes an ERC721 (NFT) to represent a revenue-generating liquid asset. The NFT is minted by the asset creator, who can then assign the incoming revenue from the asset to be distributed to the NFT. This asset creator has custody of the private keys of the revenue-generating accounts and, therefore, controls where incoming revenue is deposited. An example of an asset creator could be a network operator with a telecom tower using the Althea payment protocol at the head-end router.

On the Althea L1 network, once a liquid asset has been assigned an NFT, as microtransactions are processed the revenue generated is delivered automatically to the wallet holding the designated NFT.

Fractionalization is enabled by the Liquid Infrastructure Smart Contract (LISC). This is accomplished by locking the NFT connected to the asset into the LISC, which fractionalizes it by minting a predetermined number of fungible revenue tokens (RTs). All revenue generated by the asset now passes directly and automatically, on a pro-rata basis, to the wallet(s) holding staked RTs.

LISC is designed for flexibility and allows for single-asset fractionalization and multi-asset distribution, meaning that the revenue of several different liquid assets can be automatically distributed to a single set of fungible tokens. It is worth noting that additional liquid assets can be added at any time and set to distribute revenue to existing token sets.

Each RT therefore provides access to a relative revenue share from one, or multiple, revenue-generating assets locked in the Liquid Infrastructure Smart Contract.

Staking, Claiming, and Transfers

After a set of RTs have been minted, they must be staked so that incoming revenue can be distributed to the wallets holding them. In this case, staking refers to the act of locking the tokens in the LISC. There is no unbonding or unlocking period for staked RTs.

The revenue that the staked tokens accrue can be claimed at any time and is available shortly after a transaction is processed.

It is important to emphasize that because revenue is distributed as it is received, it is only distributed to staked tokens. If RTs are not staked, the revenue they would have made claimable is distributed to those staked. For this reason, it is advised to keep revenue tokens staked at all times, except for the brief period required to transfer them to a different wallet.

What is Keystone Liquidity Platform

Hawk Networks Inc. built Keystone Liquidity as a platform for managing liquid infrastructure tokens for the company and its affiliate network operations, construction, and for builds by our Liquid Infrastructure partners. The portal for this is located at liquid.hawknetworks.net.

Keystone Liquidity enables RT holders to easily interact with the underlying blockchain and retrieve and visualize data for the user.

For users holding RTs, the platform provides easily understandable information on historical revenue trends as well as a user-friendly interface to stake and unstake RTs and collect claimable earnings.

Keystone Liquidity also provides a user interface with management functions for owners/operators of a physical asset or network i.e. those holding a Liquid Infrastructure NFT. As an asset’s sole owner, they can directly claim income from the NFT or fractionalize the asset into an RT set.

While the Keystone Liquidity Platform is the first interface empowering users to manage and interact with Liquid Infrastructure implementations, there is no barrier preventing other parties (unaffiliated with Hawk Networks) from creating their own bespoke user interfaces. Third parties are free to build and deploy their own UI, add compatibility with different wallet managers, and optimize the UX with data visualization and command execution tailored to the specific needs of their user base. This process is straightforward and permissionless.

Third parties may also deploy new instances of the LISC, which may or may not include a whitelist, or include a different whitelist, and/or have different properties from the instance used at Keystone Liquidity.

Administration: platform and contracts

Hawk Networks Inc. holds the administration keys to the Liquid Infrastructure Fractionalizer used on the Keystone Liquidity platform. These keys have the following powers.

-

Add or remove ERC721 assets from the Liquid Infrastructure smart contract

-

Add or remove users from the whitelist

-

Mint new tokens

-

Burn tokens held by Hawk Networks.*

*Note: Tokens that are no longer in Hawk Networks’ possession (i.e. sent to fractional owner) cannot be burned.

The Liquid Infrastructure smart contract, used in the Keystone Liquidity front end, contains a whitelist of approved wallets. RTs cannot be transferred to wallets that are not whitelisted. If a wallet is removed from the whitelist, any RTs belonging to that wallet are automatically unstaked and become non-transferrable.

In order for unstaked RTs to be transferred, both the sender and recipient address must be whitelisted.

A significant security feature of the Liquid Infrastructure Smart Contract is that it is non-upgradable. There is no administrative “backdoor” to be compromised, which could otherwise enable changes to be made to the LISC.

Liquid Infrastructure is designed for the Althea L1 blockchain, and Liquid Infrastructure assets (NFT/ERC721) are managed by the chain itself. As a result, all incoming revenue is instantly posted to the asset owner as incoming microtransactions are processed.

Decentralization

The Hawk Networks Liquid Infrastructure platform, Keystone Liquidity, is partially custodial and partially decentralized. Other entities may develop different platforms than Keystone Liquidity with the AltheaL1 blockchain, which have different custodial or decentralized properties.

-

Once revenue is deposited, a Liquid Infrastructure NFT or Token can not be clawed back. It can be claimed by the holder at any time using only non-custodial, decentralized systems

-

Holding a Liquid Infrastructure NFT on Althea L1 is decentralized for all on-chain components. Revenue coming into the account is automatically locked into the NFT by the chain-logic. The physical asset components could be destroyed or replaced due to events outside of Hawk Networks’s control and interrupt the revenue stream.

-

Liquid Infrastructure ERC20 fungible revenue tokens used on the Keystone platform are subject to management by Hawk Networks, Inc., who can issue more shares, add or remove properties, and add or remove users from the holder whitelist.