This page provides a summary of Althea L1 Token Economics.

Althea L1 and the Althea Routing and Billing Platform are purpose built to combine efficient settlement of micropayments for critical real world goods with unique native, on-chain DeFi capabilities.

Althea L1 enables automated, on-chain micro payments for bandwidth and is ideal for smart meters, and grid systems, making new types of infrastructure financing and operations possible. Althea allows local and global networks to earn, pay, and settle in real time using built-in dynamic pricing and machine-to-machine billing without relying on legacy intermediaries.

Using the Althea Routing and Billing Platform, users’ home routers act as hardware wallets loaded with stablecoins, transparently purchasing bandwidth as they use the internet.

Althea L1 ushers in the new era of DeFi, Infrastructure Finance (iFi). Revenue splits, debt repayment and capital recycling are handled directly by the network itself. iFi integrates on chain settlement of real world assets such as bandwidth or electricity sales with advanced DeFi capabilities.

See the full whitepaper here.

Economics

Althea L1 has two distinct execution environments. A non-programmable transaction layer that handles microtransactions, denominated in stablecoins for real world goods and an EVM compatible layer where iFi can integrate with revenue from those microtransactions.

The microtransactions collect a governance-set fee (currently set at 10%) This fee is distributed to staked ALTHEA tokens pro-rata in the paid stablecoin. Validators and token stakers will receive USDC, USDS, or USDT for each microtransaction they include in a block. This is in addition to any other staking rewards. This mechanism reduces the need for mandatory inflation to fund staking.

Fees for transactions in the EVM layer can only be paid in ALTHEA and are burned. EVM fees are also set by governance, currently a transaction using 150,000 gas will consume about 0.03 ALTHEA. For reference at this fee level 7 million swaps will burn 1% of the ALTHEA supply.

As outlined in the whitepaper Althea LI EVM usage is driven by Liquid Infrastructure, which allows a user to create an NFT representation of the micro-transaction module earnings of their account. This is extremely useful to manage, for example, the revenue from 1,000 unique cell towers or electric vehicle chargers.

Liquid Infrastructure allows revenue from real world goods to become a composable part of DeFi, allowing for the creation of iFi (Infrastructure Finance) platforms and next generation RWA tokens powered entirely by on-chain revenue.

Since demand for EVM transactions on Althea L1 is driven by Liquid Infrastructure and not fee competition with other lower cost L1 platforms EVM fees are expected to remain high for the long term.

Demand and Usage

Althea Routing and Billing Platform predates Althea L1 in its development and deployment. It is currently used on the Gnosis chain throughout the USA by broadband providers, private wireless, and telecom operators to manage the billing, routing and funding mechanisms for their operations. Including home and business internet for thousands of customers.

Althea L1 token economics are built around this sustainable fee based revenue (frequently denominated in stablecoins), derived from usage of the platform in telecom, utilities, infrastructure or other machine driven economies.

Inflation and Burning

Governance can configure the inflation rate of Althea L1, which is currently set at 5% per year. As discussed in the fee collection section there is organic token burn generated by EVM fees and validators receive stablecoin rewards for included microtransactions in addition to any inflationary rewards.

The design goal of having validators receive rewards for included microtransactions is both to encourage rapid and reliable inclusion for small payments, and also to reduce the need for inflation to fund network security.

EVM fees are burned to discourage validator activity that would extract value from programmable transactions or burden the chain with excessive computation. Validators have a strong incentive to facilitate rapid and reliable micropayments first and foremost.

Delegated proof of stake networks require a security budget proportional to their on-chain non-native token and stablecoin TVL. Since Liquid Infrastructure and microtransactions in general drive a higher than average volume to TVL ratio it’s reasonable to expect chain security costs to be covered by the microtransaction fee if there is sufficient adoption of Althea L1.

Governance

Althea L1 uses Cosmos SDK governance. This is a delegated proof of stake system that allows validators to vote on behalf of their delegators unless the delegators cast their own vote on a specific proposal.

This means the required quorum, 33% of voting power, is met for essentially all proposals. For a vote to execute 51% of all token weighted voting power must be in favor of the proposal after the quorum has been reached.

Anyone can submit a propoposal paying only a small fraction of an ALTHEA in transaction fees. But for a proposal to enter the voting state a deposit of 500 ALTHEA is required. This deposit can be sourced from multiple contributors and is refunded unless a quorum rejects the proposal specifically as spam. A simple no vote still results in the deposit being refunded.

The voting period is currently set as 3 days, but can be changed by governance vote to a longer or shorter time period.

Governance has control over all configuration parameters, including inflation, of the chain as well as the coordination of consensus breaking software upgrades.

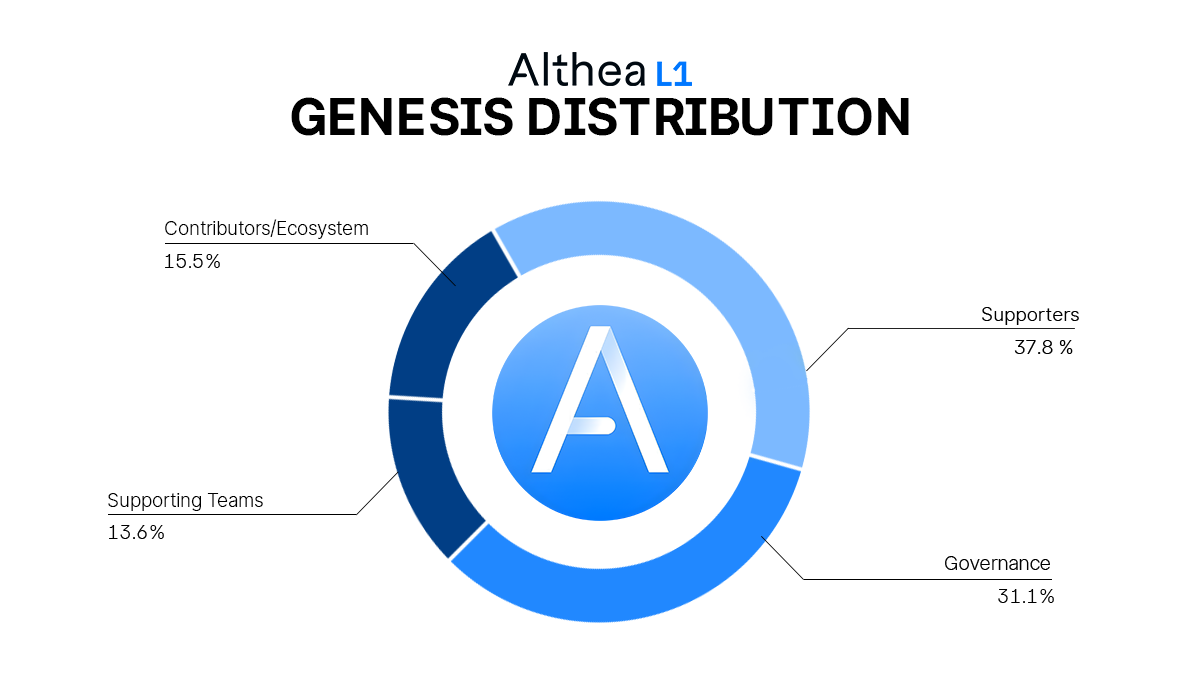

You will note in the distribution section that no one segment of the distribution can reach quorum unilaterally as the community pool (labeled Governance) can not itself vote.

Governance announcements, participation, and feedback can be found on the forum - forum.althea.net. Discussions on the forum are not binding and votes make the final call.

Unique to Althea’s approach, the funds in the community pool can be staked or participate in DeFi through direct governance, instead of sitting idle, with the fees in stablecoins distributed back to the community.

Distribution

The ALTHEA token is distributed to three main stakeholder groups in roughly equal parts to ensure a long term sustainable platform:

- Early funding supporters,

- Contributing development and community teams

- Development entities and community funds

The graph above details the distribution of the ALTHEA token at launch, with current information on token inflation and parameters displayed on the block explorer Mintscan or via the Althea L1 info API.

ALTHEA token holders have no special restrictions or lock-ups, in alignment with a “Fair Launch” approach to token participation, non-withstanding those who choose to take a voluntary lock-up at token launch.

In 2019, a securities-compliant airdrop was conducted on the Republic platform, with 5,488 participants. Not all of these participants claimed their airdrop allocations within the time frame needed to be included in the Genesis of Althea blockchain which took place on March 25, 2024.